Hotline

400-999-2278

Drawing on over 20 years of experience in SCF (Supply Chain Finance) services, the VTeam Group delivers cost-effective and easily accessible financing solutions for SMEs through commercial factoring and supply chain finance.

We offer SCF services to tens of thousands of central SOEs, anchor enterprises and SMEs.

In the Chinese market, the VTeam Group serves as the Deputy Director of CFEC (Commercial Factoring Expertise Committee). Our clients include tens of thousands of central state-owned enterprises and SMEs, such as COFCO, China Mobile, and China Unicom. We have evolved into a comprehensive SCF provider delivering risk control and management solutions for banks and other financial institutions, and financial assets securitization, refinancing, operational risk management and consulting services for commercial factoring companies, leasing companies, SCF companies and other quasi-financial institutions.

The VTeam Group has won a number of awards that give recognition to its leading position in supply chain finance, including the 2017 Preferred Service Provider for Chinese SMEs, the Top 10 Chinese Medical Financial Service Providers of 2018, the 2019 China Commercial Factoring Industry Contributor Award, the 2020 Corporate Contributor Award, and the 2021 China Commercial Factoring Industry Innovation Case Award, the 2022 Best Digital Trade Finance Platform in China by The Asian Banker, the 10th (2022) China Commercial Factoring Industry Summit “Qingtian Award, Meritorious Award, Craftsman Award, Pine & Cypress Award, and Innovation Award”in 2023, the 2023 Best Business Ecosystem Platform Initiative in China by The Asian Banker, and the 2023 China-Australia Outstanding Contribution Award for Economic Development.

We operate in 223 countries and regions across the globe

In the international market, the VTeam Group is one of China’s few SCF providers offering international factoring and supply chain finance services. As a member of FCI (Factors Chain International) and the International Trade & Forfaiting Association, our service coverage extends to 223 countries and regions worldwide. Collaborating with global partners, we provide export trade finance, offshore trade finance, overseas bank account opening and payment services. We offer one-stop financial solutions for Chinese companies expanding abroad and as well as local overseas enterprises.

Euler Hermes awarded VTeam the only Certificate of Appreciation in Asia for three consecutive years

Euler Hermes, now Allianz Trade, a global leader in credit insurance, has awarded the VTeam Group the Certificate of Appreciation and trophy for three consecutive years. These are the only such certificate and award issued by Euler Hermes in Asia, highlighting its recognition of our supply chain finance asset quality and demonstrating our outstanding risk control capabilities.

Major Products for the Domestic Business

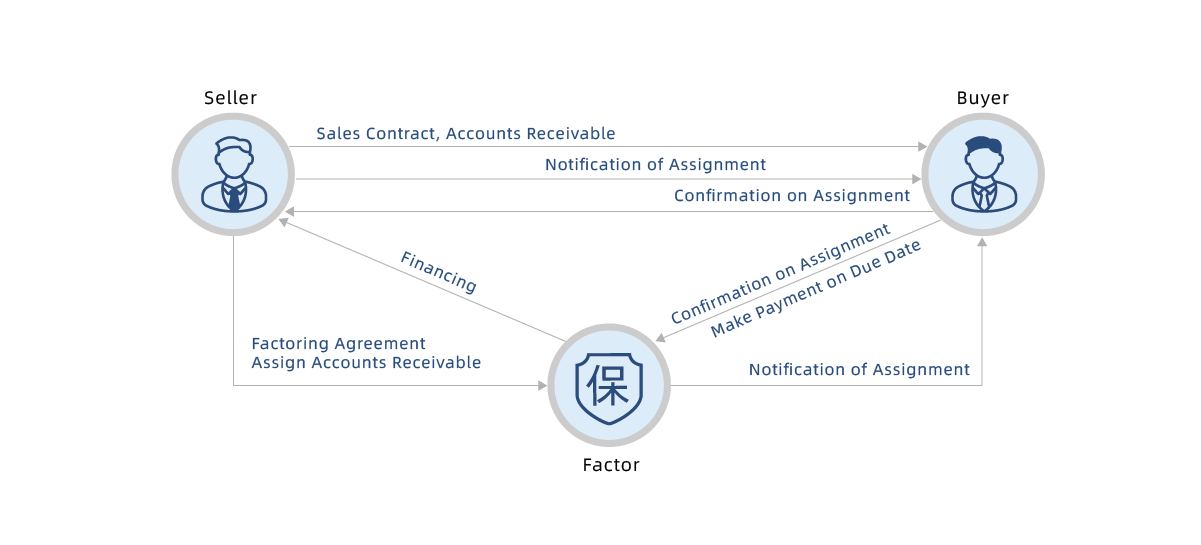

>>> Factoring / Accounts Receivable Purchase

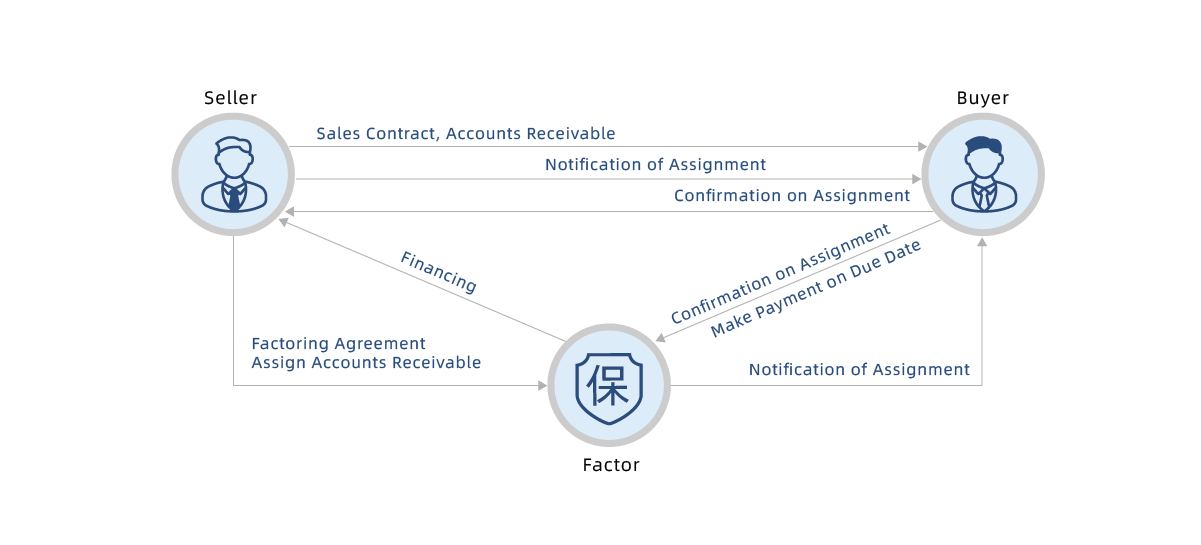

Factoring, also known as Accounts Receivable Purchase, refers to a creditor (seller) initiates a financing option. Specifically, the seller assigns its present and future accounts receivable based on the goods sales/service contract concluded with the buyer to the factor, who in return, provides the seller with a series of services, including financing, sales account management, credit risk guarantee, and collection services.

>>> Reverse Factoring / Supply Chain Finance

Reverse factoring, also known as Supply Chain Finance, refers to the initiation led by the debtor (anchor enterprise). Factors enter into reverse factoring agreements with large anchor enterprises with good credit, and provide financing for the SMEs on their supply chain network. As small-scale suppliers with limited assets can hardly reach the threshold for financing, factors can rely on the credit of the anchor enterprises to finance those suppliers' accounts receivable, which provides a financing option for suppliers, and on the other hand, improves the capital usage performance of anchor enterprises.

Drawing on over 20 years of experience in SCF (Supply Chain Finance) services, the VTeam Group delivers cost-effective and easily accessible financing solutions for SMEs through commercial factoring and supply chain finance.

We offer SCF services to tens of thousands of central SOEs, anchor enterprises and SMEs.

In the Chinese market, the VTeam Group serves as the Deputy Director of CFEC (Commercial Factoring Expertise Committee). Our clients include tens of thousands of central state-owned enterprises and SMEs, such as COFCO, China Mobile, and China Unicom. We have evolved into a comprehensive SCF provider delivering risk control and management solutions for banks and other financial institutions, and financial assets securitization, refinancing, operational risk management and consulting services for commercial factoring companies, leasing companies, SCF companies and other quasi-financial institutions.

The VTeam Group has won a number of awards that give recognition to its leading position in supply chain finance, including the 2017 Preferred Service Provider for Chinese SMEs, the Top 10 Chinese Medical Financial Service Providers of 2018, the 2019 China Commercial Factoring Industry Contributor Award, the 2020 Corporate Contributor Award, and the 2021 China Commercial Factoring Industry Innovation Case Award, the 2022 Best Digital Trade Finance Platform in China by The Asian Banker, the 10th (2022) China Commercial Factoring Industry Summit “Qingtian Award, Meritorious Award, Craftsman Award, Pine & Cypress Award, and Innovation Award”in 2023, the 2023 Best Business Ecosystem Platform Initiative in China by The Asian Banker, and the 2023 China-Australia Outstanding Contribution Award for Economic Development.

We operate in 223 countries and regions across the globe

In the international market, the VTeam Group is one of China’s few SCF providers offering international factoring and supply chain finance services. As a member of FCI (Factors Chain International) and the International Trade & Forfaiting Association, our service coverage extends to 223 countries and regions worldwide. Collaborating with global partners, we provide export trade finance, offshore trade finance, overseas bank account opening and payment services. We offer one-stop financial solutions for Chinese companies expanding abroad and as well as local overseas enterprises.

Euler Hermes awarded VTeam the only Certificate of Appreciation in Asia for three consecutive years

Euler Hermes, now Allianz Trade, a global leader in credit insurance, has awarded the VTeam Group the Certificate of Appreciation and trophy for three consecutive years. These are the only such certificate and award issued by Euler Hermes in Asia, highlighting its recognition of our supply chain finance asset quality and demonstrating our outstanding risk control capabilities.

Major Products for the Domestic Business

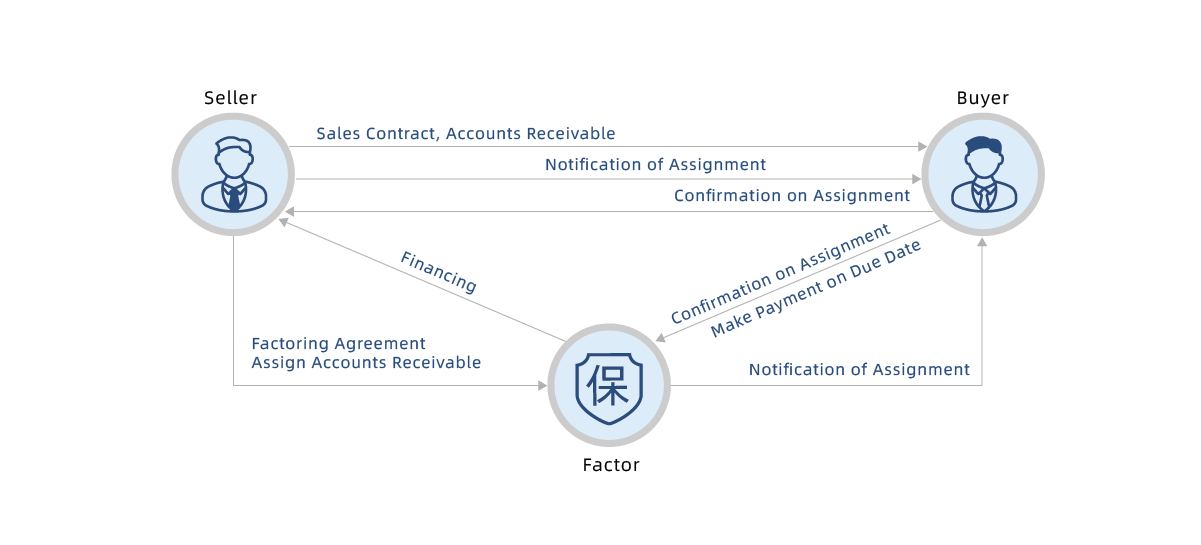

>>> Factoring / Accounts Receivable Purchase

Factoring, also known as Accounts Receivable Purchase, refers to a creditor (seller) initiates a financing option. Specifically, the seller assigns its present and future accounts receivable based on the goods sales/service contract concluded with the buyer to the factor, who in return, provides the seller with a series of services, including financing, sales account management, credit risk guarantee, and collection services.

>>> Reverse Factoring / Supply Chain Finance

Reverse factoring, also known as Supply Chain Finance, refers to the initiation led by the debtor (anchor enterprise). Factors enter into reverse factoring agreements with large anchor enterprises with good credit, and provide financing for the SMEs on their supply chain network. As small-scale suppliers with limited assets can hardly reach the threshold for financing, factors can rely on the credit of the anchor enterprises to finance those suppliers' accounts receivable, which provides a financing option for suppliers, and on the other hand, improves the capital usage performance of anchor enterprises.

Major Products for the International Business

>>> Export Factoring

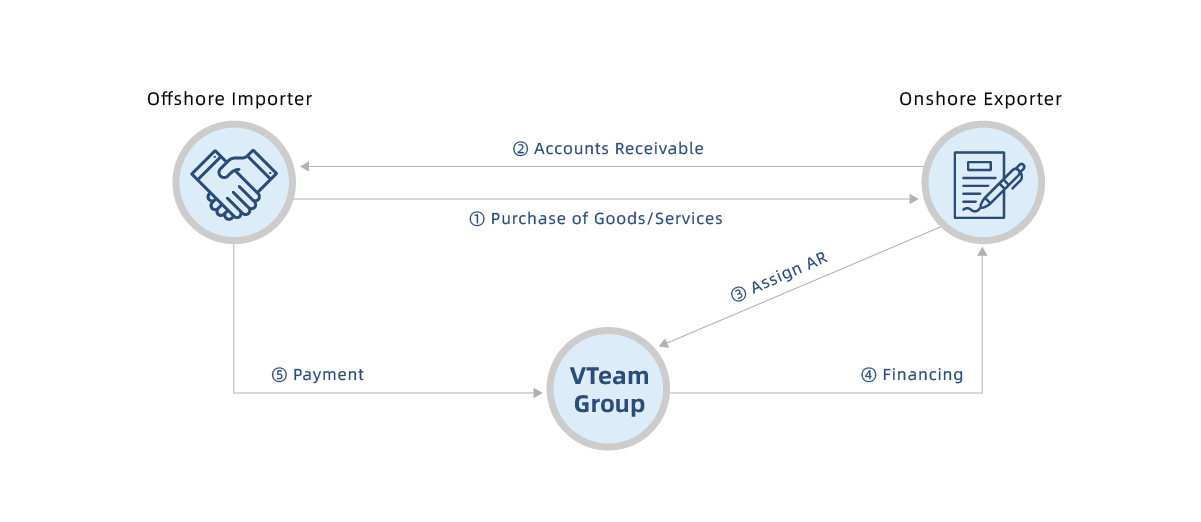

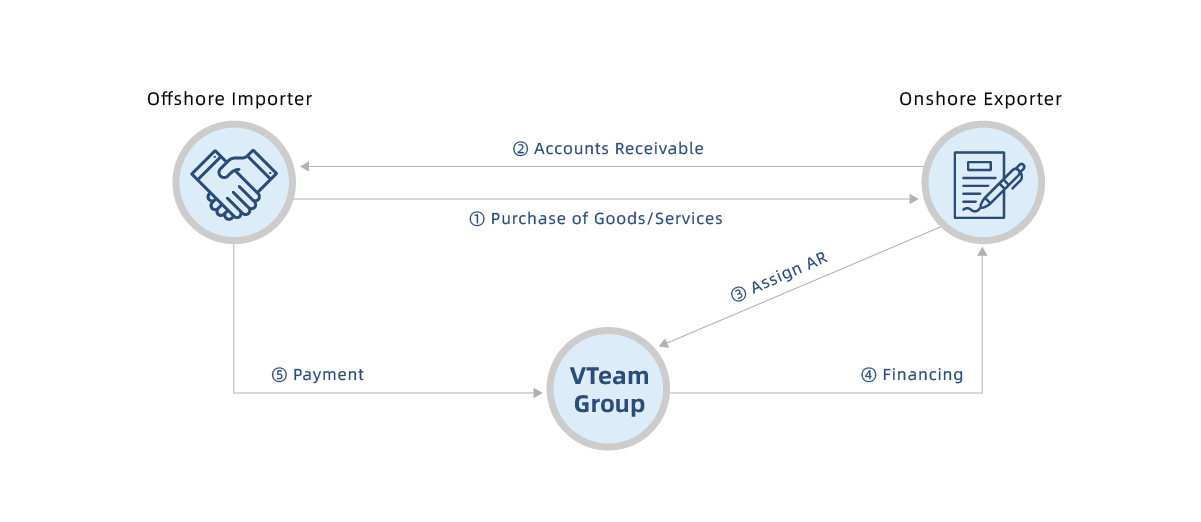

An exporter can assign accounts receivable of a high-quality buyer to the VTeam Group to obtain the working capital in advance based on the sales of open account terms. If it is under a non-recourse basis, it would be treated as off-balance sheet.

>>> Import Factoring

A Chinese or overseas importer, who doesn’t want to issue the letters of credit anymore or has adopted open account terms for their import purchases, can apply factoring to overseas exporters through the cooperation between the VTeam Group and the members of FCI in exporter’s country.

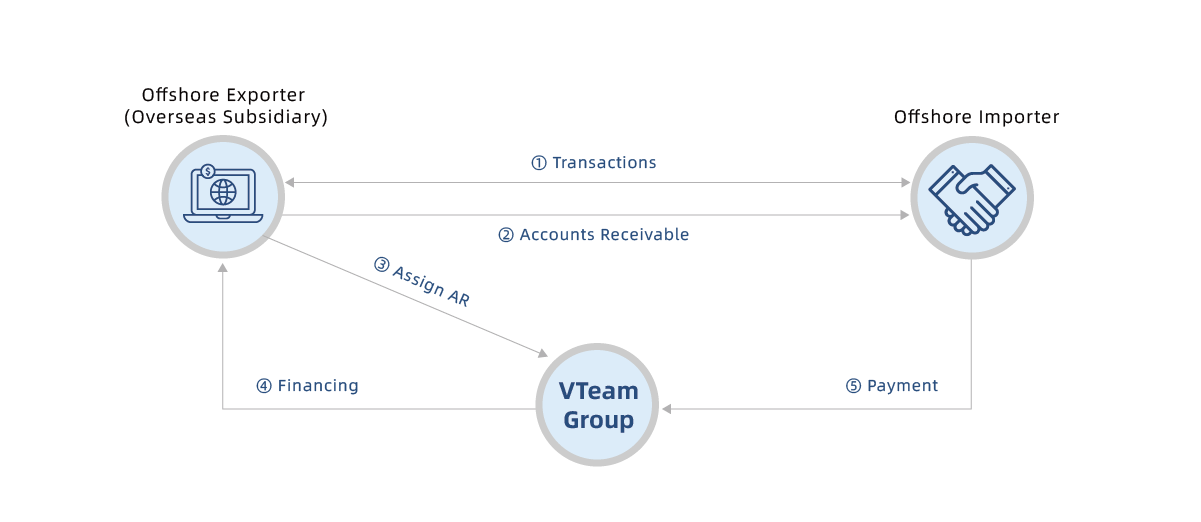

>>> Offshore Factoring

An overseas or offshore exporter can cooperate with a designated factor of the VTeam Group to obtain working capital in advance, as well as to enjoy the off-balance sheet once it is under the non-recourse basis.

>>> Overseas Services for Chinese Companies

Catering to various financial needs of Chinese companies seeking global expansion, the VTeam Group offers comprehensive solutions throughout the investigation and preparation phase, the factory/company establishment phase, and the operation phase, facilitating their sustainable growth abroad.

Scan the QR code to follow us

鄂公网安备 42018502002196号 鄂ICP备: 12009823号-4;鄂ICP备: 12009823号-5;鄂ICP备: 12009823号-6

技术支持:爱牛网络

鄂公网安备 42018502002196号 鄂ICP备: 12009823号-4;鄂ICP备: 12009823号-5;鄂ICP备: 12009823号-6

技术支持:爱牛网络